Market Context

Home care (sometimes also referred to as domiciliary care) is a range of services that are put in place to support an adult to remain living in their home. The professional, known as a carer, will provide support and complete tasks that aid an adult to remain independent and safe. The type of tasks can vary from personal care, administering medications, or supporting the adult with activities. Their primary role is to maintain the adult’s quality of life and support them to meet their outcomes.

Domiciliary care can be provided on a short-term or long-term basis. We also commission specialist services, that include home care. It is commissioned mainly through our Home Care Dynamic Pursing System (DPS).

Market Rating

There is currently ample supply of capacity in Somerset’s home care market, meaning that no one is waiting for support that will enable them to remain in their own home. The average time it takes to source a package of care is 2 days from referral to start date.

Home Care providers have increased their staff numbers over the past 2 years, mainly through international recruitment, meaning we have a workforce that is able to meet demand. This has led to a market where people are likely to have a choice of provider and we are able to offer a real person-centred service. They will also be able to remain living in their own homes for as long as it is safe for them to do so.

Current Market Status

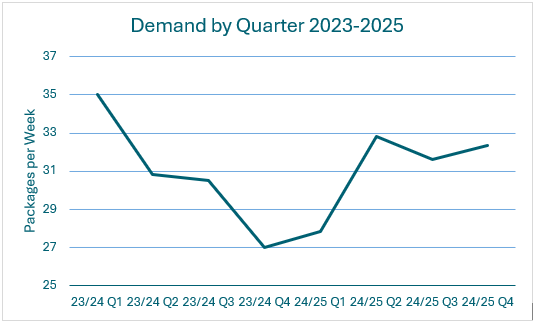

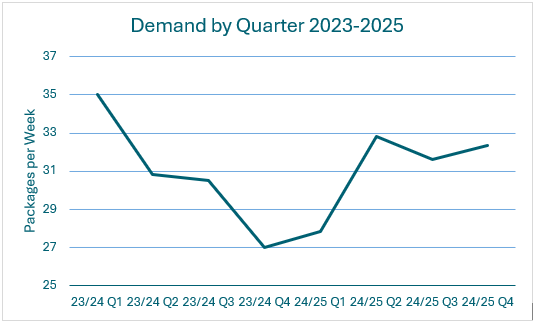

Demand for Home Care has been fairly stable over the past 2 years but we do expect demand to increase steadily as the number of older people in Somerset increases.

The predominant users of home care services are those that are over 75, and it is projected that the number of people living in Somerset that are over 75 will increase by 24% between 2025 and 2035. We are confident that the group of providers that are active in the County will be able to meet the anticipated demand in the coming years.

Somerset is a very rural county and there will always be certain areas where capacity is a challenge. We are working to improve this via the continuing growth of our community services and Micro Providers.

We have recommissioned the contracts for care at home in Somerset from April 2024 and as part of this we are committed to working with local home care companies. A condition of approval onto our framework is that an organisation has a CQC registered office within 10 miles of the Somerset border. There are currently 63 approved providers on the Somerset Home Care Open Framework, and 53 of these are supporting at least one person to remain living at home. As part of the recommissioning we contracted for 6 block contracts in areas that are either high demand or in locations where supply can be difficult and these have successfully delivered services to people in those communities.

Limiting the framework to locally based care providers will ensure that providers know Somerset, and will also protect the market from a saturation level that would impact the financial sustainability of all.

As of January 2025, there are 105 locations in Somerset registered to provide home care (this includes provision for adults of working age and older adults). In terms of quality, 70 home care providers are currently rated as good or outstanding, 8 as requires improvement and 27 do not have a current rating. Only 2 of the providers rated as requires improvement are contracted to provide 65+ home care by Somerset Council and both have worked extensively with Adult Social Care’s Quality Team to ensure services are being provided at the required standards.

Market Data

All data is correct as of February 2025

| Somerset Market – Whole Market |

|

| No. Providers |

105 |

| % Providers CQC rated Good or Outstanding |

67% |

| Providers onboarded to work with the Council since 1st April 2024 |

9 |

| Providers exiting the market since 1st April 2024 |

1 |

| Somerset Adult Social Care Market – Local Authority funded |

|

| Spend |

£29m |

| No. Providers on DPS |

63 |

| % Providers on DPS CQC rated Good or Outstanding |

71%

23% not yet inspected |

| No. Adults commissioned by Somerset Council using DPs |

1500 new packages per year. |

| Commissioned hours per week |

320 new hours per week |

| % Somerset Council funded packages with providers rated Good or Outstanding by CQC |

72% (this is based on new packages sourced in the last 3 years). 23% of packages sourced with providers who haven’t been inspected so not sure this is a true reflection of quality. |

| Packages commissioned outside of DPS since April 2024 |

0 |

Distance from desired commissioning objectives

The home care market in Somerset is currently in a stable and healthy position. We will need to ensure that future demand is taken into consideration when looking at our commissioning objectives but we are currently where we need to be for the existing demand for service.

Market Risks

There are concerns regarding the increased cost of National Living Wage (6.7%) and Employers National Insurance (1.2%) which took effect from April 2025, and the impact this will have on the cost delivering home care. Our inflationary uplift for 2025/26 will bring our hourly rate to £26 per hour, but we are also aware that some providers are charging private funders substantially more than this.

Current areas of focus for commissioners

The current priorities for commissioners are to manage the market to ensure there is ample supply to meet current and future demand whilst protecting the market from an oversupply that could make home care businesses unviable.

There has been a large increase in the number of home care providers in the United Kingdom following the workforce growth through Home Office certificates of sponsorship. This has led to providers from all over the country offering to send carers to Somerset. It is important to protect the Somerset market from potential oversupply that would lead to good quality, established Somerset businesses having to exit the market.