Residential and Nursing Care Home Market

Market Context

Care homes are services that support an adult who requires short- or long-term care in a Care Quality Commission (CQC) registered residential and nursing homes. The type of services that can be provided in a registered residential care home are:

- Short or long-term residential and nursing care.

- Short or long-term specialist care, i.e. dementia

- Respite residential or nursing care.

While the vast majority of people supported will be aged 65 and over, this market also includes people below the age of 65 for whom these types of service would be appropriate, for example people with early onset dementia.

Market Rating

The current overall Market Quality is good. There is currently a good amount of registered residential care and nursing homes in the market, although there is variation across Somerset with under supply in some areas and oversupply in others. There is a need to work with the market to ensure care home provision meets future demand and need, including an increase in nursing care provision and supporting adults with more complex needs later in life.

Current market status

- There are 112 care homes in Somerset that provide services to older people.

- These homes have 5,090 beds registered with CQC.

- As at 5th February 2025 there were 608 admittable vacancies (12% of total beds).

- Average occupancy in these homes stands at 83% with the remaining 5% of beds either unavailable or reserved.

- Of the 4,218 occupied beds, Somerset Council currently commissions 1,671 beds, which is just below 40%.

- The number of local authority funded beds varies greatly in each home with the highest proportion of beds in one home being 86% and three homes where there are no local authority funded people.

We have recently completed a procurement exercise for block bed contracts with care homes across the county, providing residential, nursing, and mental health support to people living with dementia. As part of our recommissioning efforts, we have written new specifications that emphasise the importance of developing specialism around behaviours that challenge in order to improve practice and support retention of our valued workforce.

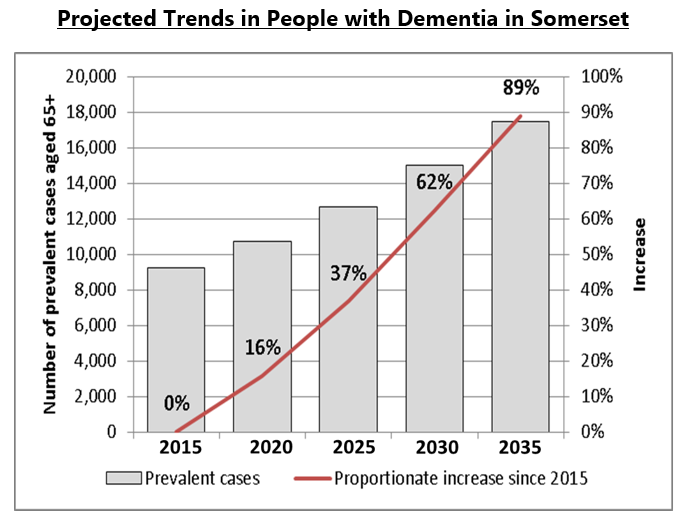

In the longer term we believe there will be more demand for Nursing and Residential beds for people with mid to high levels of dementia. As of January 2023, NHS England estimated that just under 10,000 people in Somerset have dementia and this number is predicted to grow to 18,000 by 2035.

Market Data

All data is correct as of February 2025

| Somerset Market | |

|---|---|

| No. Care Homes | 112 |

| No. Rooms | 5090 |

| % Homes CQC rated Good or Outstanding | 87% |

| Total Occupied Rooms (including Somerset Council funded) | 4218 |

| Occupancy % | 83% |

| Occupancy % for Somerset Council funded Adults | 40% |

| Market Entrants since 01/04/2024 | 0 |

| Market Exits since 01/04/2024/td> | 0 |

| Somerset Adult Social Care Market – Local Authority funded | |

|---|---|

| Spend | £64m |

| No. Contracted Homes | 111 |

| % Contracted Homes CQC rated Good or Outstanding | 87% |

| No. Adults funded by Somerset Council receiving residential care or Nursing Care | 1671 |

| % Somerset Council funded placements CQC rated Good or Outstanding | 87% |

| Contract Utilisation | 40% |

| Average Length of Stay (years) | 2 Years 3 months |

| Somerset Adult Social Care Market – Local Authority Sourcing | |

|---|---|

| Somerset Council Rates for 2025/26: Residential Care Dementia Residential Care Nursing Care OPMH |

£805 per week £859 per week £832 per week (excludes FNC) £1127 per week (excludes FNC) |

| Average placements per month during 2024/25 | 61 |

| % Admissions into residential care CQC rated Good or Outstanding | 86% |

Distance from desired commissioning objectives

Somerset Council wishes to reduce the number of people requiring Residential care over the next 10 years, and key to this work that is underway to further develop our model of Extra Care Housing, beginning with new contractual arrangements that came into effect from April 2025. The success of this policy could impact upon a number of the care homes that are registered to provide residential care only. We will need to work with our provider market to identify homes that could be suitable for conversion to Nursing homes to meet future demands for these services. We will also work with Somerset Council’s planning team to ensure that any new care home applications are considered alongside our knowledge of the social care landscape in Somerset. This work will mean that we have the right care homes built in the right locations to meet future demand and where the location is not right developers are asked to consider alternative types of social care services.

Market Risks

There are concerns regarding the increased cost of National Living Wage (6.7%) and Employers National Insurance (1.2%) which took effect from April 2025, and the impact this will have on the cost of running a care home. These costs will be passed on to the local authority and private funders via increased fees and could have an impact on our ability to find people a care home placement as quickly as we have been able to over the past year. The current time to source a placement is 18 days from request to move date.

Current areas of focus for commissioners

The current areas of focus for commissioners are:

- Supporting the upskilling of the residential care home market to support the increasing levels of people living with Dementia.

- Remodelling the respite and day opportunities support offered within care home settings, based off the individual communities.

- Recreating the equipment policy in care homes.

- Creating a framework for spot contracts within Somerset.