18+ Domiciliary Care market

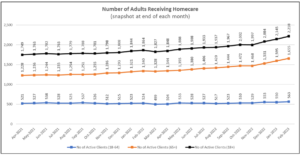

Demand for domiciliary care for people over 65 has increased significantly over the past 2 years and continues to grow. The graph below illustrates this increase and shows the number of people receiving care in their own home has increased by 27%. During this period there has also been an increase in the average size of a home care package from 11 hours per week to 13 hours per week. The graph also clearly shows the growth in capacity available since November 2022. There has been an increase in the number of younger adults receiving home care, although this is a smaller rise of 8%.

Like most home care markets in England, Somerset is suffering from a workforce shortage brought on by rising demand and difficulties recruiting and retaining staff. Recruitment of local staff is proving difficult with unemployment in Somerset at a very low level. Skills for Care data shows that vacancy rates have increased for the period where data is available. It is estimated that there were 4,500 posts filled at April 2022, but with a vacancy rate of 13.4%, which would equate to roughly 700 vacant posts.

The end of freedom of movement within the EU following Brexit has meant that providers are now having to recruit internationally via home office sponsorships. This is an expensive and time-consuming option and one that not all providers are prepared to explore. We are already working with providers to help with the costs of international recruitment and more funding from Government would help Somerset Council support our Providers to further increase their workforce.

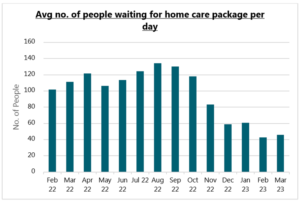

There has been a large increase in the amount of capacity available in the home care market since the submission of the provisional MSP. This has mainly been driven by those providers who were early to explore international recruitment and have now welcomed those recruits into Somerset. This has led to a reduction in the daily average number of people waiting for care in their own home from 118 to 46.

Based on end of month figures:

Hospitals in Somerset remain under immense pressure but without this additional capacity generated in the community the situation would be worse. We are now looking to build on the successes of these companies as we look to encourage others to grow via international recruitment.

The average number of returned packages of care (contract handbacks) per month during 2022/23 was 18.6. This compares to 22.5 for 2021/22.

Although occasional care package handbacks are not uncommon and can occur for a variety of reasons, most commonly staffing capacity issues within the provider, these rose sharply in Somerset during the pandemic as evidenced by annual stats below:

- 2020 – 54 package handbacks

- 2021 – 233 package handbacks

- 2022 – 238 package handbacks

Care package contract handbacks place additional pressure on Local Authority staff to find replacement care within a stretched care market and is an indicator we monitor closely as part of commissioning and quality activity

Somerset is a very rural county and home care capacity is a particularly challenging issue in those areas. Additional travel costs are agreed with providers where appropriate however the biggest issue is having the carers available and willing to travel to remote parts of the county. We are in the process of recommissioning our home care contract and intend to work in much smaller geographical zones in the future. It is hoped that this change of emphasise and the use of some block contract hours can help alleviate some of the issues we have supporting people in more remote areas of Somerset.

We have worked with our home care market to ensure that carers are paid a minimum of £10.50 per hour. This has had a positive impact on retention however with the National Living Wage increasing to £10.42 from April 2023, there will be pressure on providers to increase wages beyond this figure to remain competitive with retail and hospitality in the recruitment market. These additional costs will need to be passed on the local authorities and self-funders through increased fee rates.

Services are currently commissioned through an open framework. This has led to a diverse market in terms of provider size. Across all services there are currently 59 providers delivering support to at least 1 person. However, 50% of the overall delivery is undertaken by just 9 providers, so despite having a large and diverse market we are still reliant on a small number of providers for half of the support delivered.

Delaying the increase to capital thresholds has a big impact on the home care market as it will maintain the self-funder market. It was our assessment at the time of writing the provisional Market Sustainability Plan that this market would all but disappear in Somerset when the thresholds increased. This gives the local authority more time to work towards the cost of care as the funding available does not allow this to be achieved immediately. This should enable the home care market to remain viable now and to grow, allowing us to meet future demands.

Assessment of the impact of future market changes between now & Oct 2025

We have surveyed all home care providers to gain information on the self-funder market in Somerset and 35% of active providers responded. These providers do account for 52% of SCC funded home care delivery. This has allowed us to make a reasonable estimate of the split between local authority funded support and self-funders, which came out at 56% LA, 44% self-funders.

Changing the capital threshold limits will have a big impact on the home care market in Somerset due to the likelihood that a large proportion of self-funders would become eligible, meaning there is very little private market remaining. As a result, it is a sensible move to delay reforms to give local authorities more time to work with the market to prepare for the changes and for fee rates to increase to a level that will make the changes easier to implement. Equalisation of the private and local authority fee is the right thing to do, but only if councils are funded properly to do so. Implementation of the changes without sufficient funding will break the social care system.

Plans to address sustainability issues

Somerset made a substantial financial investment into the domiciliary care market for 2022/23 and plans to increase fees by 13% for 2023/24[1]. It is planned that fees will continue to increase in 2024/25 and 2025/26, at which point it is anticipated we will be paying the cost of care identified by providers during that exercise.

The home care market in Somerset has reacted more positively to the proposed fee rates for next year and beyond with the majority of home care being commissioned at our published rate. We have a large and diverse home care market that has reacted well to the capacity pressures we were seeing in the summer. The sustainability of this market to meet future growth will be impacted by our ability to financially support providers to continue increasing their workforce via international recruitment.

Somerset is at the start of a process to re-commission home care contracts which will expire in April 2024. The overall aim is to re-design home care in Somerset to a more localised place-based offer which enables carers to work closely within the local community. This would reduce the amount of time and money spent on travelling between care calls and make the job more attractive as a profession. We hope that this will create capacity in the market. We also aim to remove the burden of collecting contributions from people in receipt of services, which providers are currently contractually obliged to do.

[1] Decision – Adult Social Care Fees and Charges 2023-24 – Modern Council (somerset.gov.uk)